virginia estimated tax payments corporate

The Corporate Net Income Tax rates based on. The safe harbors for corporate estimated tax are both 100.

2012 Virginia Estimated Income Tax Payment Vouchers For

Corporate and Pass-Through Entity Taxes.

. Virginia estimated tax payments corporate Thursday April 21 2022 Edit. If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this. An estimated payment worksheet is available.

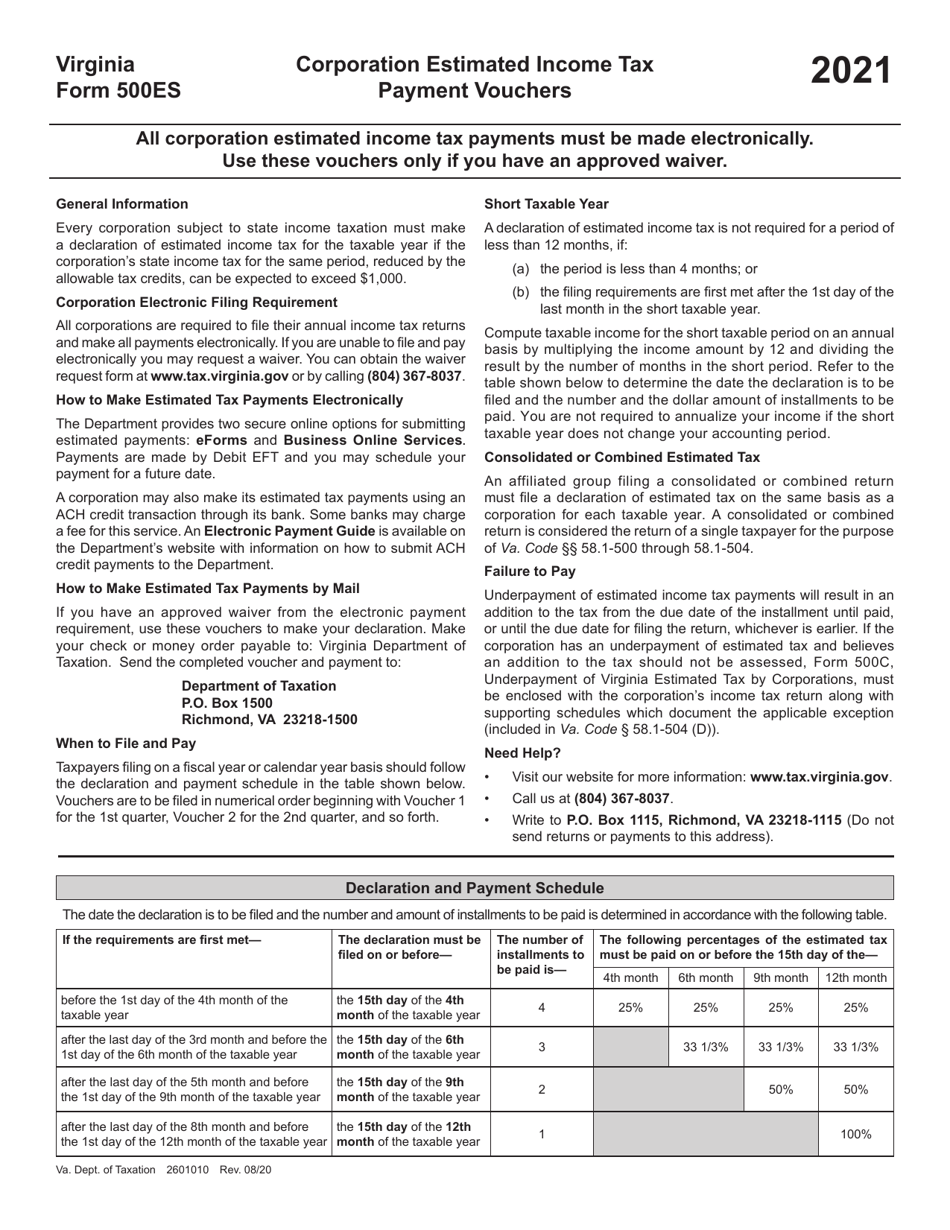

All corporation estimated income tax payments must be made electronically. Call us at 804 367-8037. Form 500es Download Fillable Pdf Or Fill Online Corporation Estimated Income Tax Payment Vouchers 2021 Virginia Templateroller Please note a 35 fee may be assessed if your.

The Virginia income tax on the composite return must be computed using the highest rate specified under Va. Or make your tax due payments through tax software when filing corporate income or. Please enter your payment details below.

Pay bills or set up a payment plan for all individual and business taxes. Box 1500 Richmond VA 23218-1500 804 367-8037 VOUCHER 2 VOUCHER 1 Attention. Use the appropriate mailing address below when mailing your payment.

The interest waiver applies to any individual corporate or fiduciary estimated virginia income tax payments that. S CORPORATION FILING FORM WVPTE-100 Taxable Year End. Underpayment of Virginia Estimated Tax by Corporations must be enclosed with the corporations income tax return along with supporting schedules which document the applicable exception included in.

Httpswwwtaxvirginiagovindividual-estimated-tax-payments How to make an estimated payment We offer multiple options to pay estimated taxes. Please enter your payment details below. Nonresident Withholding Tax Payment.

Code 581-320 on the partnerships income attributable to the qualified nonresident owners included on the composite return without the benefit of itemized deductions standard deductions personal exemptions credits for income taxes paid to states of. Use electronic funds transfer to make installment payments of. Code 581504 D.

Use the same taxable year and method of accounting as you use for Federal Tax Purposes. Make tax due estimated tax and extension payments. If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this.

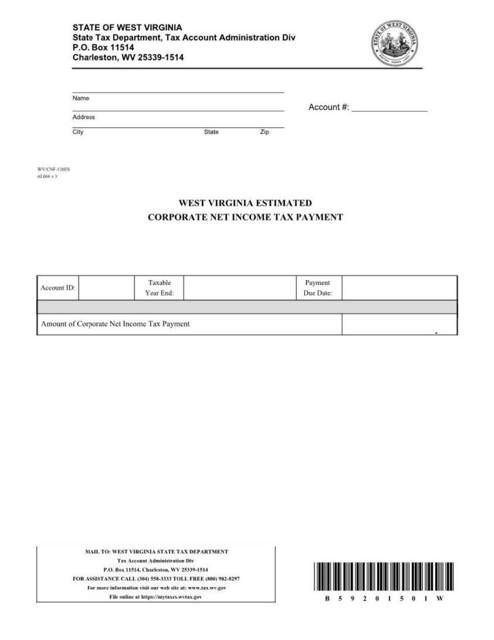

If West Virginia taxable income is expected to be at least 10000 when the annual income tax return is filed estimated payments of the Corporate Income Tax liability are required and due. Please enter your payment details below. Virginia Department of Taxation PO Box.

Visit our website for more information. Virginia Estimated Tax Declaration For Corporations Virginia Department of Taxation PO. Virginia Department of Taxation PO Box 27264 Richmond VA 23261-7264.

Virginia Department of Taxation PO Box 27264 Richmond VA 23261-7264. We last updated the Estimated Corporate Income Tax Payment Formerly CNF120ES in March 2022 so this is the latest version of CIT120ES fully updated for tax year 2021. Log in to your individual online.

Virginia estimated tax payments corporate thursday april 21 2022 edit. An estimated payment worksheet is. WEST VIRGINIA STATE TAX DEPARTMENT Tax Account.

You must pay at least 90 of your tax liability during the year by having income tax withheld andor making timely payments of estimated tax. Virginia Department of Taxation PO Box 27264 Richmond VA 23261-7264.

Form 500es Download Fillable Pdf Or Fill Online Corporation Estimated Income Tax Payment Vouchers 2021 Virginia Templateroller

When Are Taxes Due Tax Deadlines For 2022 Bankrate

Taxes In Loudoun County Loudoun County Va Official Website

1958 Blue Hills Golf Corporation Dewey W Henry Churchill Drive Roanoke Virginia Ebay

2014 Virginia Tax Form Fill Out Sign Online Dochub

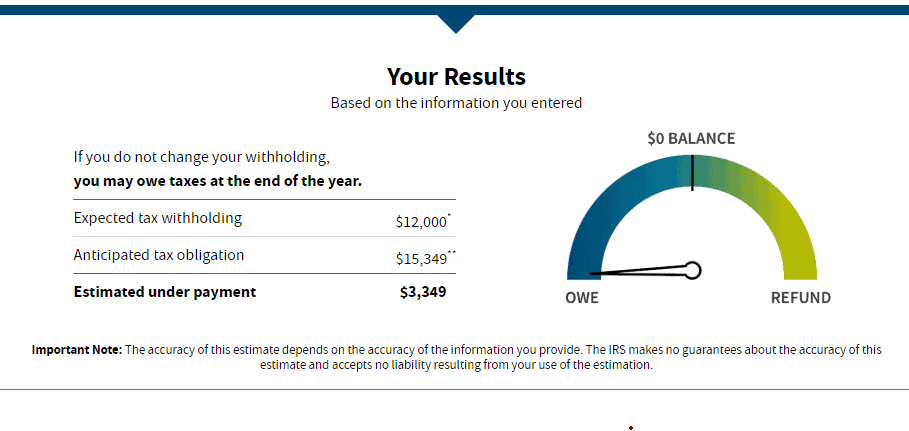

Tax Withholding Estimator Shortcomings Virginia Cpa

Corporate Tax In The United States Wikipedia

Where S My Refund The Irs Refund Schedule 2022 Check City

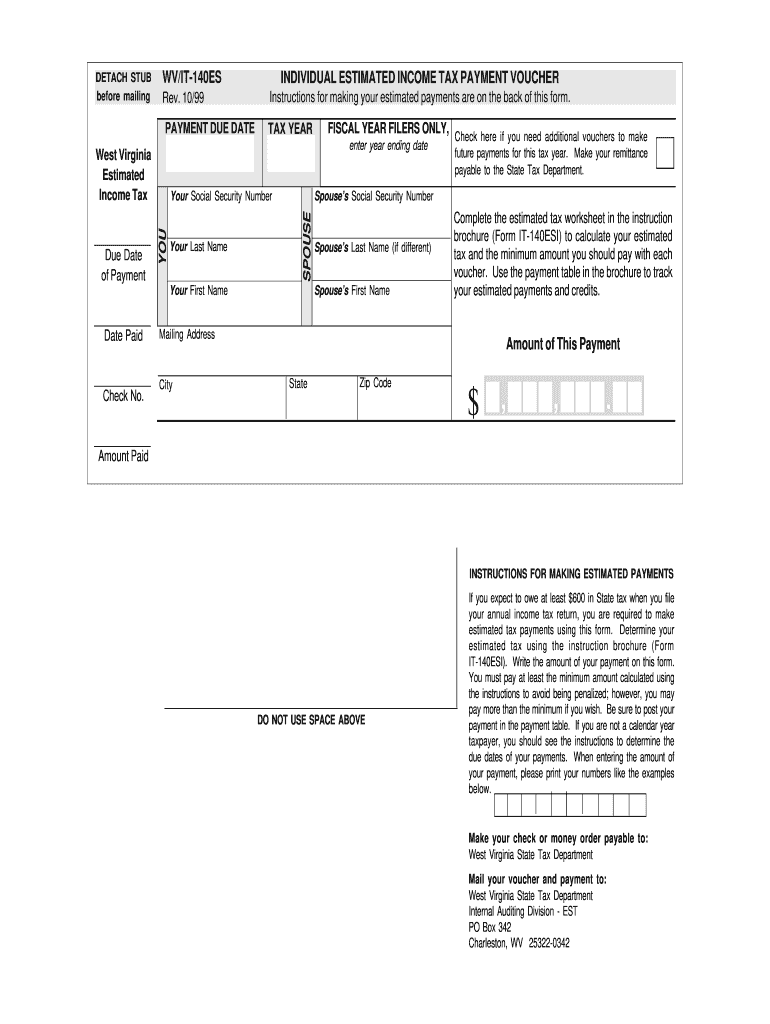

1999 Form Wv Dor Wv It 140es Fill Online Printable Fillable Blank Pdffiller

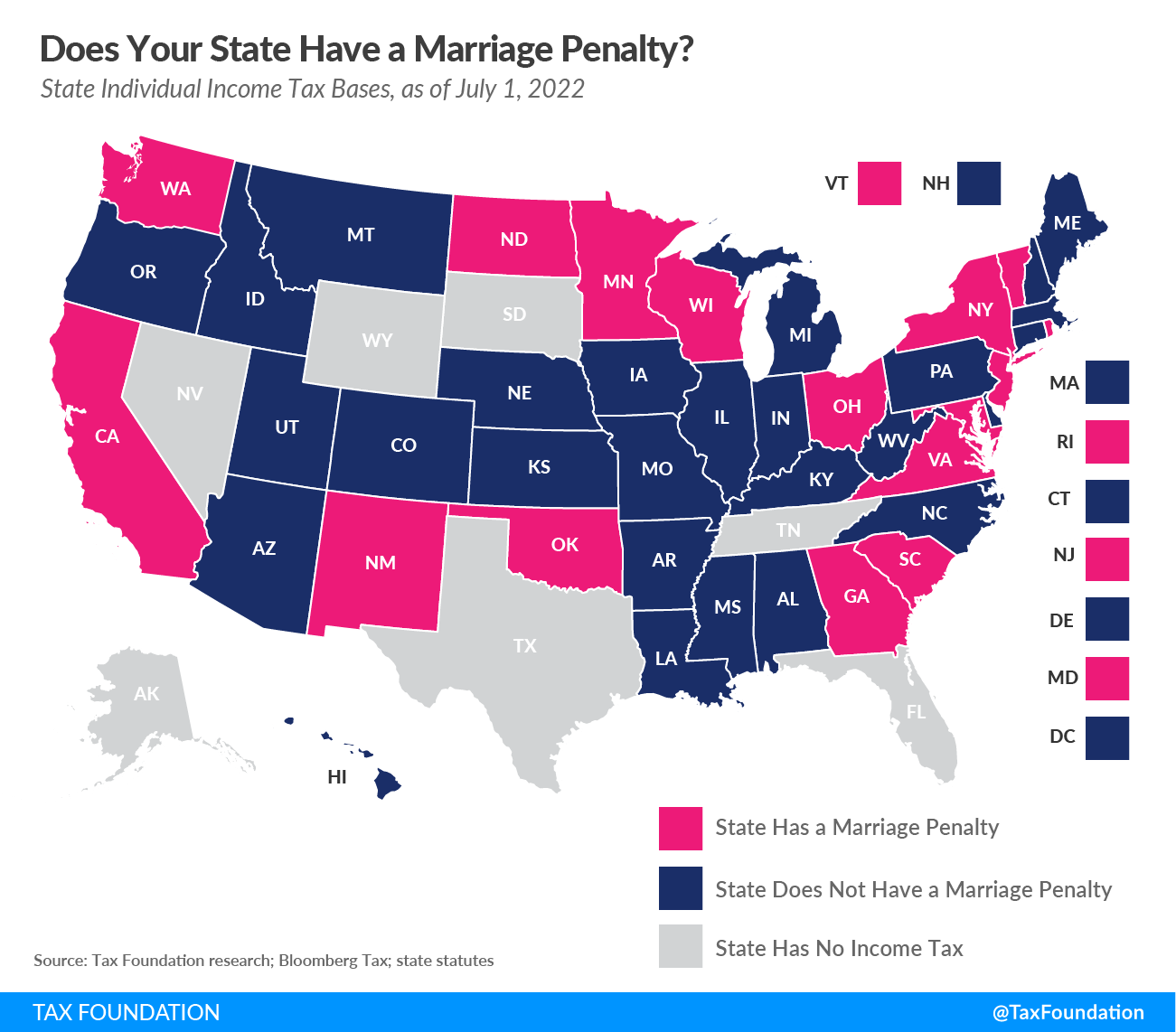

Virginia Tax Rates Rankings Virginia State Taxes Tax Foundation

Treasurers Association Of Virginia Virginia Department Of Taxation 1 Local Estimated Tax Payments Howard Overbey Tax Processing Manager June 23 Ppt Download

Individual Estimated Income Tax Estimated Pdf4pro

Virginia Department Of Taxation Virginia Tax Reminder Individual Estimated Tax Payments Are Due On June 15 More Info Https Www Tax Virginia Gov Individual Estimated Tax Payments Facebook

Corporate Tax In The United States Wikipedia

Form Wv Cnf 120es Download Printable Pdf Or Fill Online Estimated Corporate Net Income Tax Payment West Virginia Templateroller

How Congress Can Stop Corporations From Using Stock Options To Dodge Taxes Itep

Updated What Tax Filings And Payment Deadlines Have Been Extended By The Irs And The Virginia Department Of Taxation Sands Anderson Pc Jdsupra

Form Spf 100 Es Estimated Income Business Franchise Tax Payment For S Corporation And Partnership